Imagine it’s 2030, and your investment portfolio adjusts automatically as market winds shift. And that loan application? A chatbot, not a cracky branch manager, approves it in minutes.

Is this Science fiction? Not at all. This is the reality that Generative AI is cooking up for financial services, and SPOILER ALERT: it’s starting now!

While “AI” is flung around like free candy at a fintech conference, Generative AI isn’t just hype – it’s the technology we have all been waiting for ages to come.

Generative AI in financial services is all about winning hearts with personalized customer experiences, fraud detection that outwits even the smartest scammers, and many more!

But here’s the catch: Only experts with clear strategies can harness the full potential of Generative AI. Saying that we have curated an exquisite guide for you that comes with everything you want to know about Generative AI in financial services!

So, without any further ado, let’s begin!

What Is Generative AI, And Why Does It Matter In Financial Services?

The AI Generative is the Leonardo da Vinci of the AI world- it doesn’t only analyze, but creates things you can’t even imagine!

Generative AI in financial services is like having an artist who can develop financial plans, the sweetest chatbots, or even fraud detection tools that operate faster than your espresso machine in the morning.

Traditional AI is all about pattern recognition and prediction, whereas generative AI generates entirely new content – reports, customer communications, or even simulated datasets.

Generative AI 101 – Breaking Down the Basics

Generative AI is powered by advanced machine learning models, such as GPT (Generative Pre-trained Transformer) or GANs (Generative Adversarial Networks). These models learn patterns in existing data to create human-like text, images, or other types of content.

It’s like having a super-intelligent intern who can read every financial report ever written and can draft a perfect version for you in seconds.

But why does Generative AI Matter In Financial Services? Financial services are drowning in data, and generative AI brings this ocean of information alive and transforms it into actionable insights. Didn’t get our point? Well, you will in the thread ahead!

Why Generative AI is Super Perfect for Financial Services?

The monetary business flourishes with productivity, accuracy, and client trust. Here is where computer based intelligence Improvement Administrations proves to be useful to be your hero in a custom fitted suit:

Speed and Precision - man-made intelligence can draft client correspondences, sum up reports, and even reproduce market situations — errands that used to require hours are currently finished in minutes.

Personalization - Generative computer based intelligence can fit monetary counsel to individual clients, causing them to feel like celebrities. Who doesn't need a monetary system as customized as their espresso arrange?

Information Use - It examines verifiable and continuous information, transforming it into conjectures, customized offers, or misrepresentation cautions.

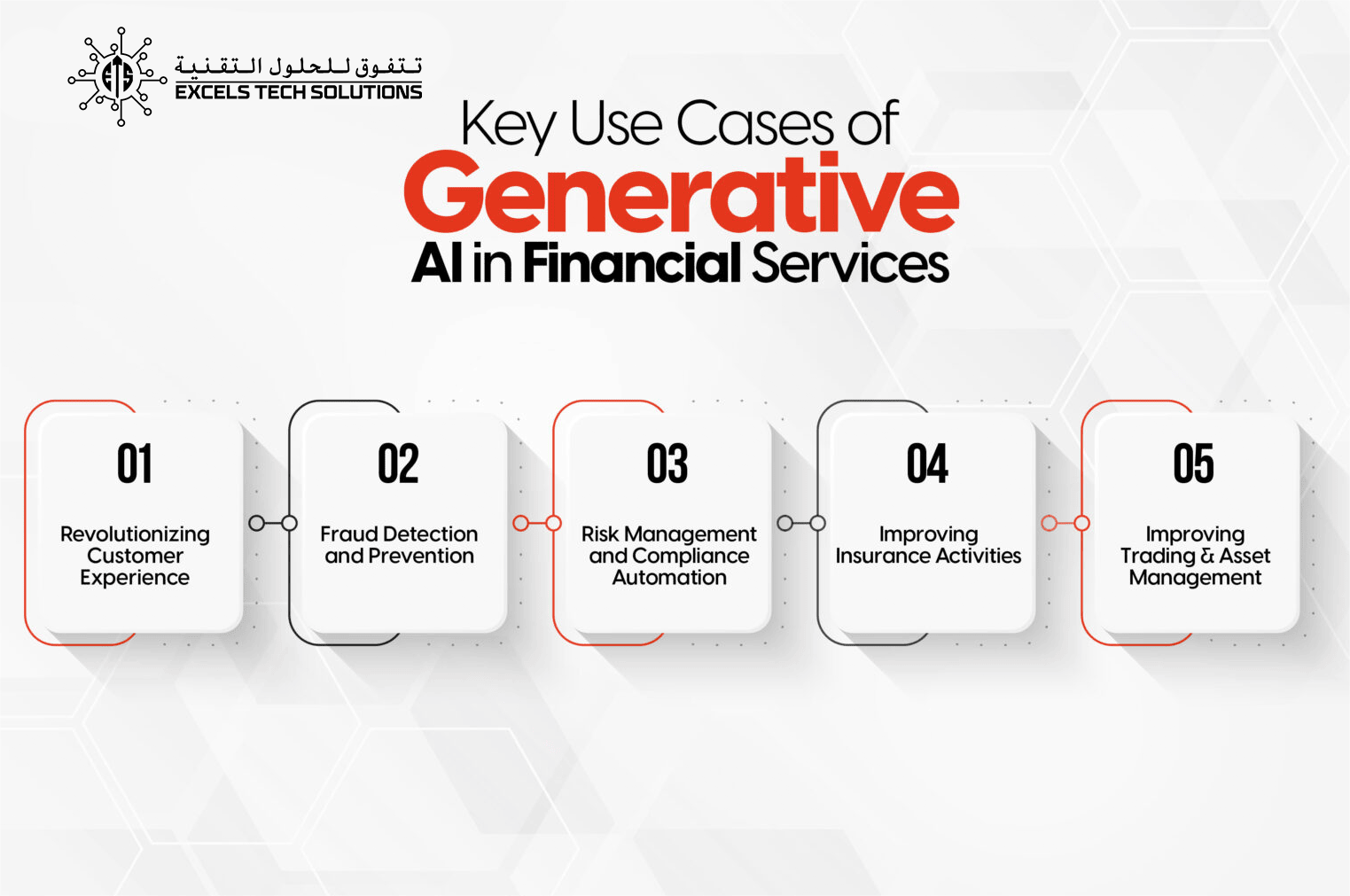

Revolutionizing Customer Experience

Revolutionizing Customer Experience Fraud Detection and Prevention

Fraud Detection and Prevention Risk Management and Compliance Automation

Risk Management and Compliance Automation Improving Insurance Activities

Improving Insurance Activities Improving Trading and Asset Management

Improving Trading and Asset Management

Applying generative AI to the world of financial services might feel like trying to land an aircraft during a thunderstorm – high stakes, high complexity, and huge margins for error.

The benefits of generative AI are mind-boggling, but still, generative AI is not a magic wand. Clear planning, strong governance, and a tech-savvy team are all needed for successful deployment.

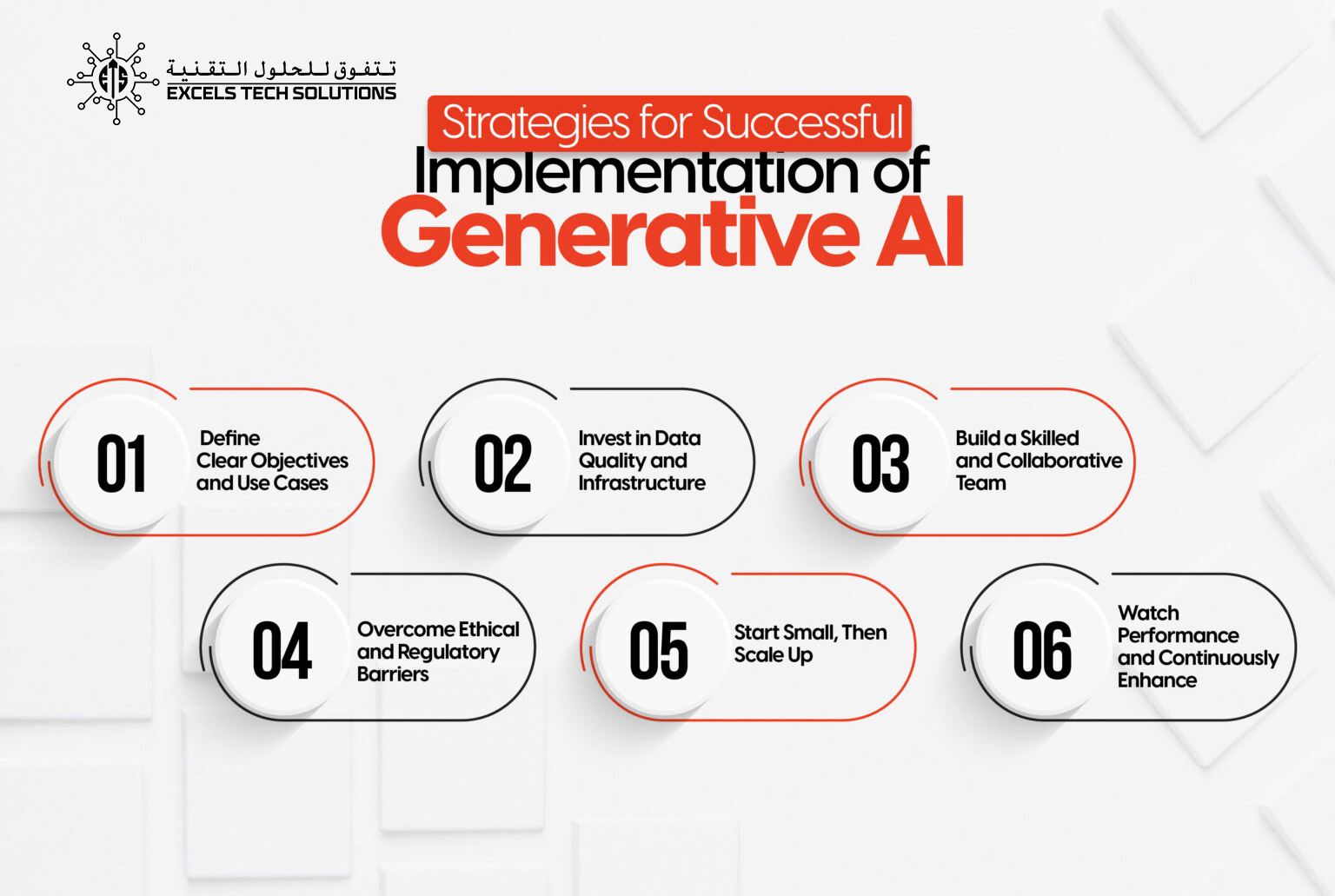

Let’s break down the key strategies for deploying generative AI in finance.

1. Define Clear Objectives and Use Cases

Jumping into generative AI without clear goals is like building a house without blueprints – you’ll be wasting your money only. Start by identifying where generative AI can add the most value to your organization.

- Identify Pain Points: Is customer service your strongest part? Are manual compliance tasks eating up your team’s productivity? Generative AI-powered financial solutions can automate these areas.

- What’s really important? Focus on applications that provide measurable returns, such as fraud detection, portfolio optimization, and personalized marketing strategies.

- Align to SMART goals: Ensure goals are specific, measurable, achievable, relevant, and time-bound. Obviously, if you’re thinking of “Cut loan processing by 30 percent in just a month through the implementation of generative AI,” – this is not going to happen!

2. Invest in Data Quality and Infrastructure

Let’s be honest – generative AI is only as good as the data it’s trained on. Poor quality, incomplete, or biased data will result in lousy outputs, which is exactly what a financial institution does not need.

Banks like JP Morgan have successfully implemented AI in financial operations by modernizing legacy systems and adopting cloud platforms for real-time data analysis.

Here’s how you can be the next JP Morgan:

- Clean and Organize Data: Financial data exists in silos or traditional CRM systems, transaction records, and risk management tools. Centralize this data and ensure its accuracy before feeding it into AI systems.

- Upgrade Infrastructure: Generative AI models require robust computational power. Cloud-based solutions are ideal for scaling and operationalizing generative AI.

- Ensure Real-Time Access: AI applications in banking and finance thrive on real-time data analysis, especially for fraud detection and risk management.

3. Build a Skilled and Collaborative Team

The role of generative AI in banking and financial management goes beyond algorithms, as you need people to make it work. Just like in any other industry, Without a skilled and collaborative team, no talent, even the most advanced AI tools, will be unused.

- Upskill Your Workforce: Educate employees about the concepts and tools of generative AI and their place in AI-powered workflows. Provide training on deploying AI models, prompt engineering, and ethical AI use.

- Bring on specialists: Hire data scientists, machine learning engineers, and AI ethicists to lead the implementation.

Make cross-functional collaboration the norm: Generative AI is not an “IT department” project. Make sure to collaborate with the operation, compliance, marketing, and risk management teams to align business goals.

4. Overcome Ethical and Regulatory Barriers

AI in financial services is practiced in one of the most heavily regulated sectors, which means that issues related to compliance and ethics cannot be compromised.

- Transparency: Design AI systems that can explain the decisions being made. In the case of rejection, explain why the loan is being rejected.

- Bias Monitoring: Generative AI can sometimes unknowingly perpetuate bias in financial decision-making. Audit models regularly to catch and address biases.

- Stay Ahead of Regulations: Financial regulations like GDPR, Dodd- Frank and Basel III must be factored into your AI strategy. Engage legal and compliance teams early to ensure smooth adoption.

- Real-World Example: Banks using generative AI for credit scoring must ensure that their models comply with anti-discrimination laws while maintaining transparency with customers.

5. Start Small, Then Scale Up

One of the most effective ways to deploy generative AI in finance is to begin with small, controlled pilot projects. Many banks started by installing AI-powered chatbots in their customer support services as the entry point for deploying generative AI.

You can do the same. However, once you get a hold of it, try pushing your existing Generative AI model to do more complex tasks like document processing and credit scoring.

- Test and Iterate: Launch AI models in a single department, such as fraud detection or customer support. Measure their performance, gather feedback, and refine the system.

- Scale Gradually: Once the pilot delivers results, scale the solution across other areas, such as loan underwriting or claims processing.

6. Watch Performance and Continuously Enhance

Generative AI isn’t a “set it up and forget it” machine. It needs continuous tracking and optimization to ensure consistent results.

- Monitor ROI: By tracking the most important KPIs, such as time saved, fraud prevention rates, and improvements in customer satisfaction.

- Gather Feedback: Teams and customers should be encouraged to give feedback regarding AI-powered financial solutions. Apply the feedback to refine the models of AI.

- Remain Agile: The finance world is changing fast, just like AI capabilities. The models should be frequently updated to reflect new regulations, changing market trends, and other customer needs.